In the Tokyo foreign exchange market on the 19th, the yen exchange rate temporarily fell to the low 148 yen level to the dollar, as expectations that interest rates would be cut early this year in the United States receded.

In the Tokyo market on the 19th, there was a strong movement to sell yen and buy dollars, and the yen exchange rate temporarily fell to the 148.80 yen level for the first time since late November last year.

This is because the results of the unemployment insurance claims announced in the United States on the 18th have led to widespread belief that the American economy is strong, and the view that the Federal Reserve will cut interest rates early this year has receded. .

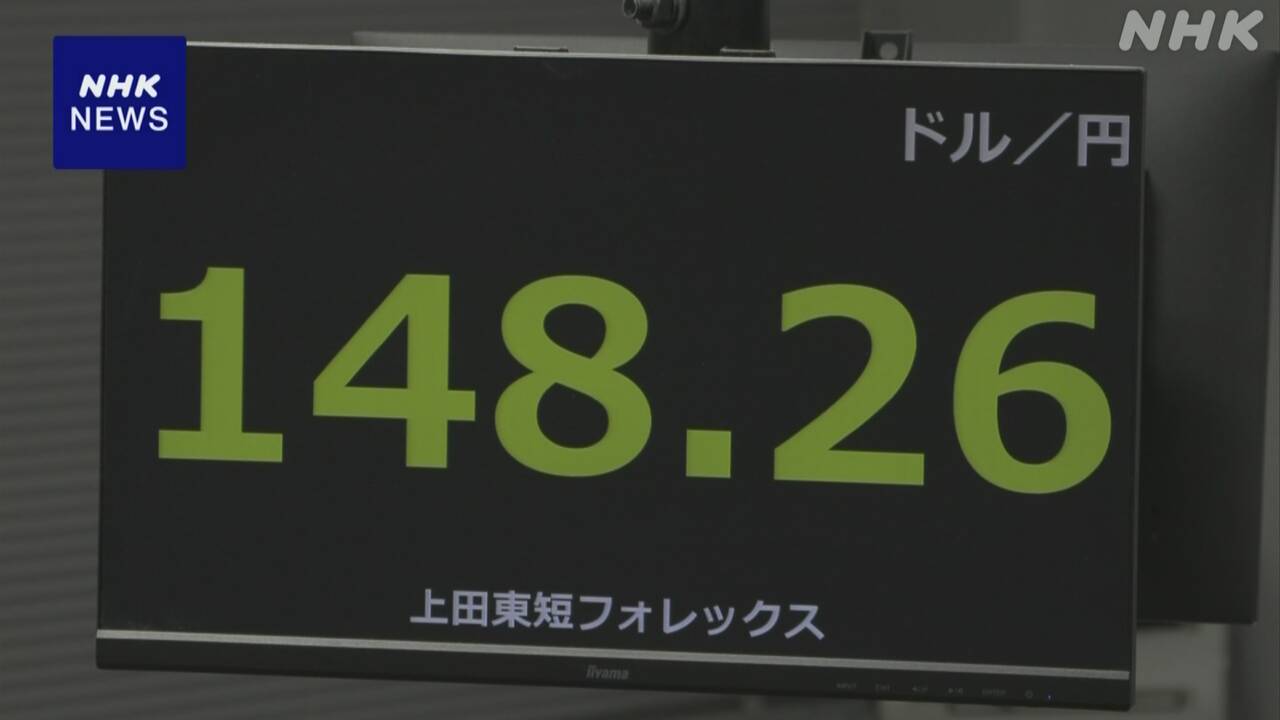

As of 5 p.m., the yen exchange rate was 50 sen weaker and stronger against the dollar, from 148 yen 26 to 28 sen compared to the 18th.

Against the euro, the yen weakened by 43 sen compared to the 18th, and the euro appreciated from 1 euro = 161 yen.30 to 34 sen.

The euro was 80 dollars against the dollar, 1 euro = 1.0879.

A market source said, ``Investors' attention will be focused on next week's monetary policy meeting held by the Bank of Japan.As there is a growing view that it will be difficult to lift negative interest rates early, the focus will be on the extent to which the bank will indicate its policy direction. ”.