In the foreign exchange market on September 9, the yen depreciated due to the widening of the interest rate differential between Japan and the United States, mainly due to the view that monetary tightening would be prolonged in the United States, and the yen continued to trade at the mid-28 dollar = 1 yen range.

In the foreign exchange market, in the early morning of the 28th, the yen weakened and the dollar appreciated until the latter half of the 1 dollar = 149 yen range in the New York market.

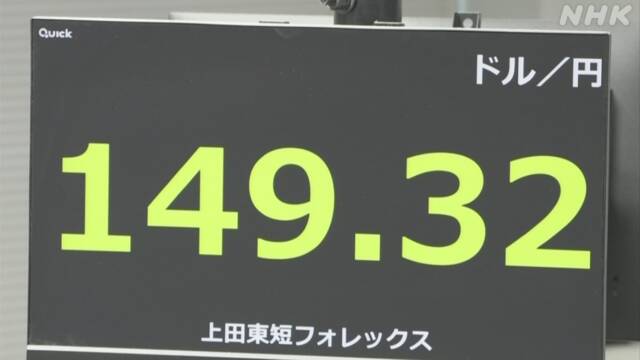

In the Tokyo market, trading continued at the mid-1 dollar = 149 yen range, but price movements were limited due to a strong sense of caution about market intervention by the government and the Bank of Japan.

As of 5 p.m., the yen was 29 sen lower than the previous day, and the dollar was 1 dollar = 149.31 yen ~ 32 sen.

On the other hand, against the euro, the euro weakened by 53 sen compared to the previous day to 1 euro = 156.92 yen ~ 96 sen.

The euro was 1 euro = 1.0509 ~ 10 dollars against the dollar.

A market participant said, "Price movements were limited due to the market awareness of 1 dollar = 150 yen as a milestone and heightened caution against market intervention by the government and the Bank of Japan Japan.